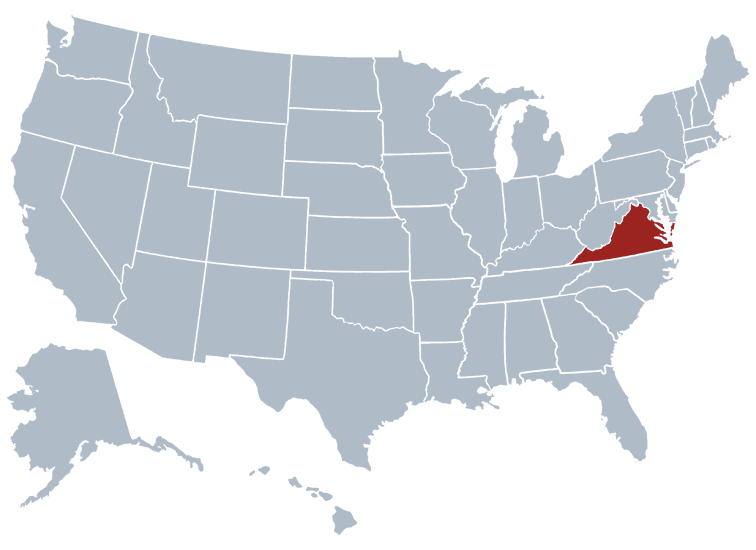

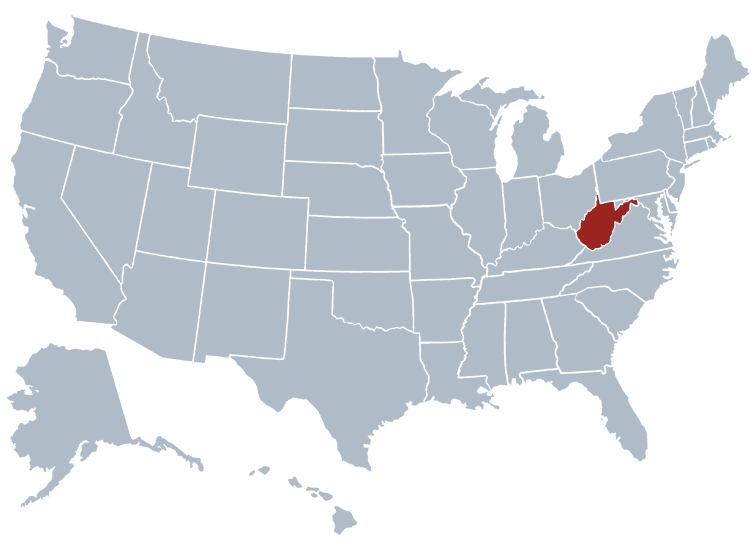

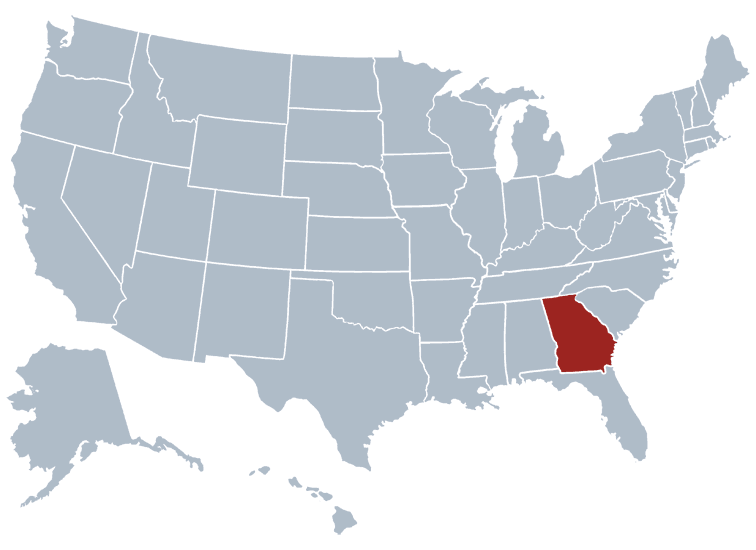

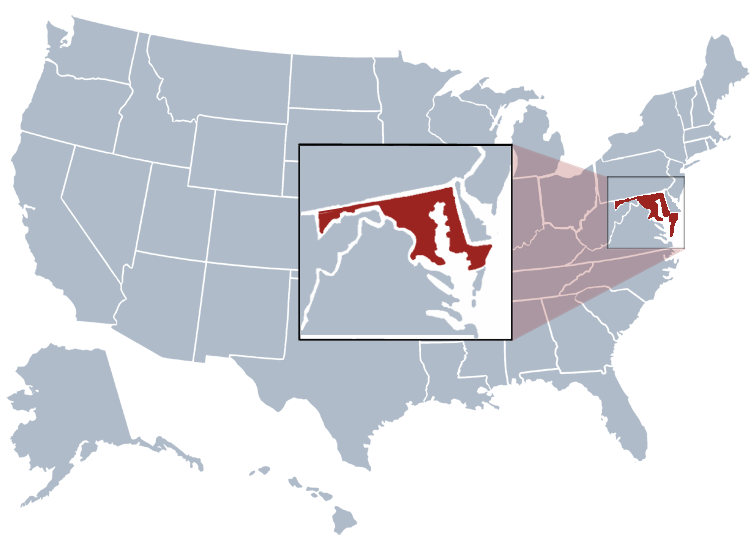

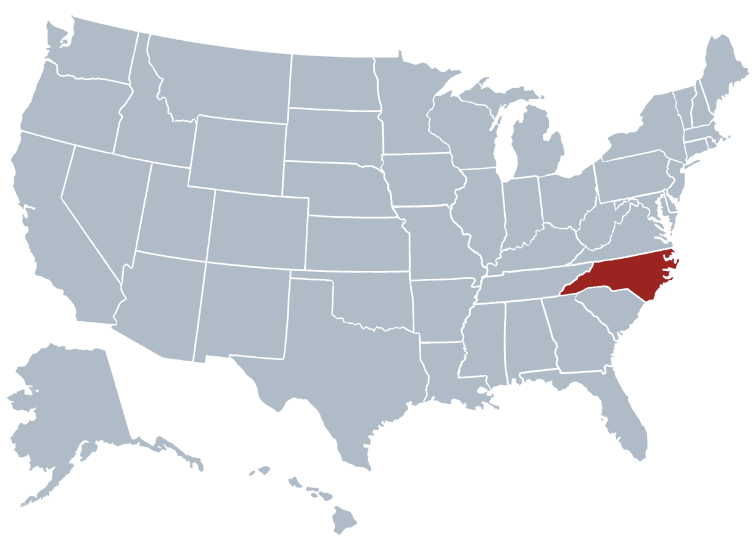

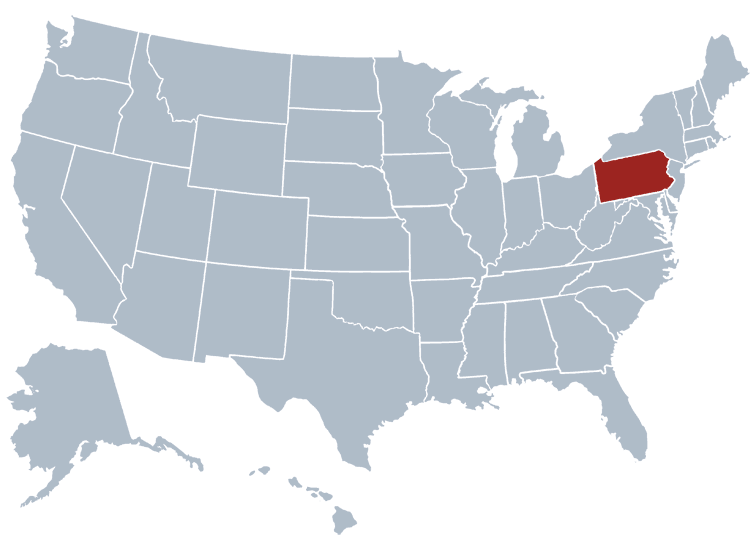

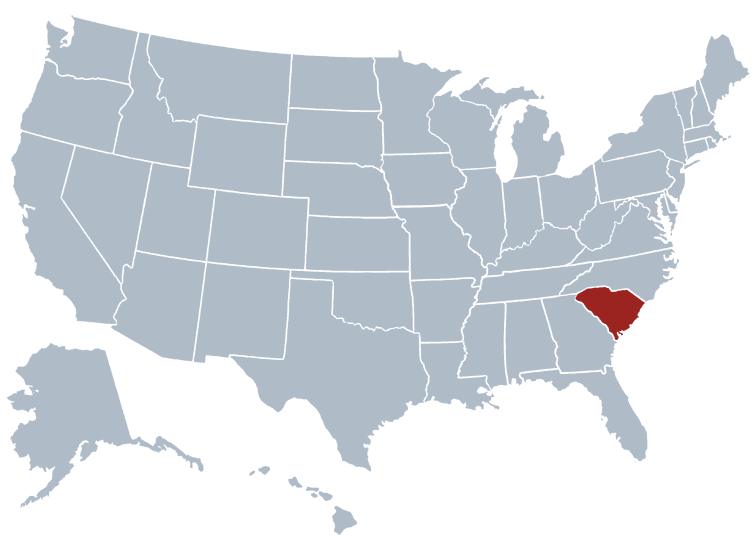

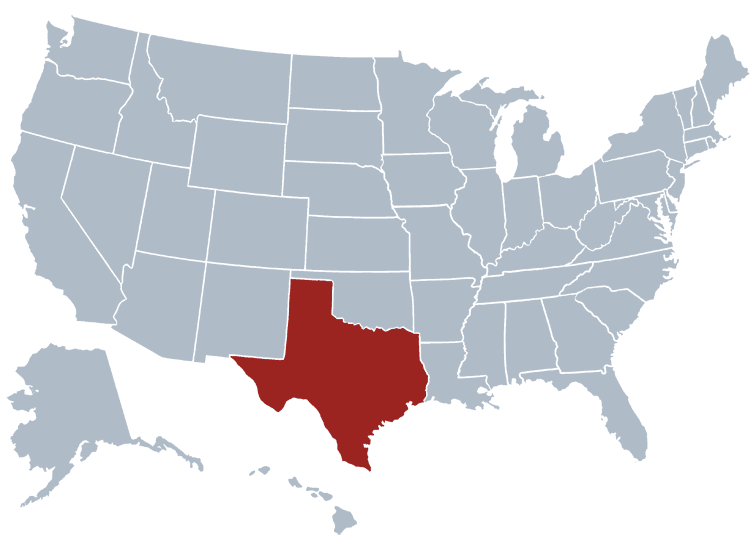

For state-specific long-term care insurance information, please choose your state.

HELP YOU MAKE INFORMED DECISIONS ABOUT LONG-TERM CARE.

I am committed to educating consumers about long term care insurance by providing an easy-to-use website filled with simple definitions and educational videos about long-term care insurance terms and concepts. By providing simple explanations for complex long term care insurance terms, consumers become empowered to make intelligent buying decisions that impact their financial and family lives.

This website is not sponsored by any insurance company, nor does it promote any particular insurance company or policy. It is our goal to have sample policies for all of America’s top insurers available for you to research at your leisure in the comfort of your home.

Every consumer has different financial needs and health history, which is why educating consumers is especially important. Once consumers understand the intimate relationship between their personal health history and financial situation, then they are ready to begin shopping and comparing long term care insurance policies offered by the various companies.

HOW TO USE THIS WEBSITE?

This website is designed for consumers seeking to learn more about long-term care insurance. At the top of the page you will see “LTCI DICTIONARY”. This page contains a list of long term care insurance terms with easy to understand definitions. Some terms will have definitions only, and some will have other useful articles about that term.

WHAT IS LONG-TERM CARE?

Long-term care includes a variety of services that may be both medically and/or non-medically necessary for people with a chronic illness or disability. Health and personal needs are met through long-term care. Generally speaking, long-term care provides people assistance with activities of daily living, such as bathing, dressing, eating, toileting or transferring. People of all ages may need long-term care.

Choosing long term care insurance is an important decision. Planning for long-term care requires you to think about possible future long-term care needs and costs. It is important to plan for long-term care before you need it, and before a crisis occurs. By thinking and planning your choices now, you will have more control over your individual situation, possibly remaining independent longer. Even when you plan ahead, making long-term care decisions can be very difficult.

You may never need long-term care. Even if you make careful plans and arrangements, you may never need it. According to the US Department of Health and Human Services, “This year, about nine million men and women over the age of 65 will need long-term care. By 2020, 12 million older Americans will need long-term care. Most will be cared for at home; family and friends are the sole caregivers for 70 percent of the elderly. A study by the U.S. Department of Health and Human Services says that people who reach age 65 will likely have a 40 percent chance of entering a nursing home. About 10 percent of the people who enter a nursing home will stay there five years or more.”

HERE ARE A FEW FACTS WHICH MAY SURPRISE YOU:

- Long term care insurance is very flexible. Every long term care insurance policy gives you many choices for your benefits. You choose your: Monthly Maximum, Inflation Benefit, Lifetime Maximum, and Elimination Period. The richer the benefits you choose, the higher your premium. The more modest the benefits you choose, the lower your premium. You are in control of those choices.

- Shop around. You can save thousands of dollars over your lifetime by shopping and comparing prices from several of the top long term care insurance policies. Every long-term care policy has a unique way of calculating your premium based upon your age, your choice of benefits, and your health history. When comparing several of the leading policies, with nearly identical benefits, premiums will often vary by as much as 70%.

- Premium Payment Periods. You can choose one of four premium payment periods for your long-term care policy. You can choose: a stepped premium payment, a standard premium payment, a shortened premium payment, or a single premium payment. A “stepped premium payment” method can start off about 30% less than a “standard premium payment” method.

- Use pre-tax dollars. You can significantly decrease the “net cost” of your long-term care policy by using pre-tax dollars to help pay your long-term care insurance premiums. There are now 10 different ways owners of long-term care insurance can save on their federal and state income taxes. Depending upon your state and federal income tax bracket, this can decrease your “net cost” by 30% or more.

- Buy a Partnership-Qualified Policy. Now that 40 states have “Long-Term Care Partnership programs” you do not have to buy an expensive “unlimited” long-term care insurance policy. You only need to buy an amount of long-term care insurance equal to the amount of assets you want to protect for yourself, your spouse or partner, and/or your heirs. The Long Term Care Partnership programs provide dollar-for-dollar asset protection. Each dollar that your Partnership-Qualified Policy pays out in benefits entitles you to keep an extra dollar of countable assets if you ever need to apply for Medicaid services.

Can a long term care insurance policy pay a relative to care for you?

It depends upon the policy.

Most long-term care policies are “reimbursement” policies. A “reimbursement” policy will only pay benefits after you’ve received care from a “qualified care provider.”

With most “reimbursement policies”, a relative cannot be a “qualified care provider”.

Under certain conditions, there are some “reimbursement policies” that can pay benefits for care you receive from a relative:

- Your relative must be a regular employee of the organization that is providing your care.

- The insurance company will not pay your relative directly.

- The insurance company will pay the organization that employs your relative.

- Your relative would only receive their regular wages from the employer.

Some long term care insurance policies are “cash policies”. A “cash policy” will pay the policy’s full benefits to you each month regardless of who is providing your care. You can pay anyone to care for you with the benefits from the “cash policy”.

“Cash policies” are certainly more flexible than “reimbursement policies”, but they are also more expensive. When comparing similar benefits, a “cash policy” may cost twice as much as a “reimbursement policy”.

Some insurers have developed affordable reimbursement policies that also include a limited amount of “cash benefits”. There are 3 types:

- Some “reimbursement policies” will pay a portion of the benefits “in cash” each month. You can do anything you want with the “cash benefits.” The percentage of the benefits that is payable as a “cash benefit” each month ranges between 10% to 50%,depending upon the policy.

- Some “reimbursement policies” will pay the full Daily Benefit for each day that you receive even just a small amount of care from a “qualified care provider”. You can choose to use a small portion of the Daily Benefit to pay the “qualified care provider”. The remainder of the Daily Benefit can be used anyway that you want to, including paying a relative who may be providing most of your care.

- Lastly, there are some “reimbursement policies” that give you the option, at the time of claim, to receive a smaller amount of the benefits in cash, in lieu of receiving the full benefits. For example, if your “reimbursement policy” has a $6,000 Monthly Benefit, at the time of claim, you can choose to receive 40% of the Monthly Benefit as a “cash benefit” ($2,400).

WHAT HAPPENS TO MY LONG-TERM CARE POLICY IF MY INSURANCE COMPANY STOPS SELLING NEW POLICIES?

N-O-T-H-I-N-G.

I know that’s not what the newspapers say.

I know that’s not what the headlines on the “news websites” say.

But fear sells newspapers and fear increases hits on their websites.

Fear (and lies) zoom through cyberspace faster than the truth does.

The truth just isn’t sexy enough.

The fact is that whether or not your insurer continues to sell new long term care insurance policies has ZERO impact on your long-term care policy.

“Will they cancel my policy if they stop selling new long term care insurance policies?”

No. They canNOT cancel your policy. The only way your policy can end is if you fail to pay the premium in a timely manner.

“Won’t they reduce the benefits in my long term care insurance policy?”

No. By state law, the insurance company cannot reduce your benefits without your consent. You can choose to reduce your benefits at anytime, if you want to reduce your premium. The insurance company, however, cannot unilaterally decide to reduce your benefits.

“If they stop selling new long term care insurance policies, won’t they just raise my premiums?”

No. Your premium is not dependent upon new policies being sold. Your long term care insurance premium could go up regardless of whether your insurance company continues to sell new policies or discontinues selling new policies. (There are two types of long term care insurance policies that can never have a premium increase. If you have one of those two types then your premium can NEVER go up.)

Whether your premium goes up or not has nothing to do with whether or not your insurance company continues to sell new policies.