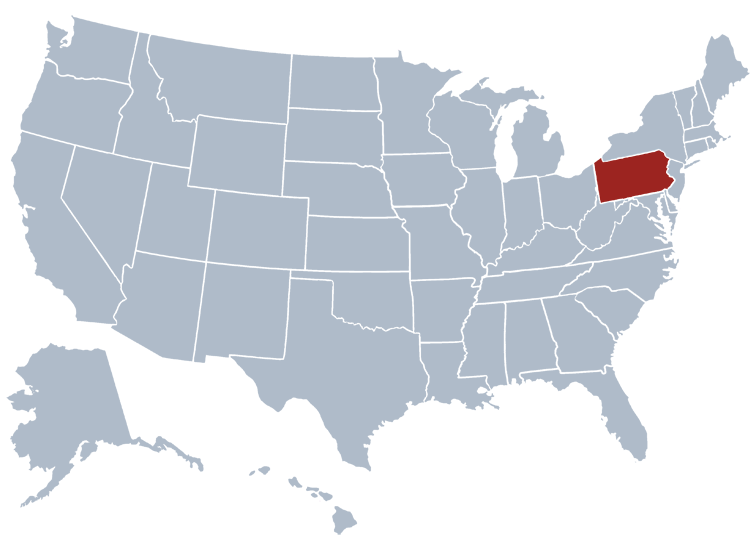

Long Term Care Insurance Policy Brochures for Pennsylvania

On July 17, 2007, Governor Edward G. Rendell signed Act 40 into law, granting strong consumer protections for purchasers of long-term care insurance and helping to address the growing need for long-term care services. Act 40 also establishes a “Long-Term Care Partnership”, which offers Pennsylvanians the opportunity to provide for their own needs while helping to conserve taxpayer resources.

The new law protects consumers by requiring that all long-term care insurance policies sold in Pennsylvania provide comprehensive coverage and also gives consumers the ability to exchange existing policies for Partnership Policies. Additionally, the law increases the guaranty fund to protect consumers against loss if an insurance company becomes insolvent. The Long-Term Care Partnership encourages Pennsylvanians to purchase long-term care insurance by providing asset coverage equal to the benefits paid by the policy. This means dollar-for-dollar asset protection. For example, a person whose qualifying policy paid for $100,000 of care would be entitled to keep $100,000 in assets if they need to apply for Medical Assistance in the future.

In Pennsylvania, Medical Assistance is the largest payer of long-term care services. In order to qualify, an individual must spend down or exhaust their resources, leaving many families reliant on public assistance. People who purchase Long-Term Care Partnership Policies may still qualify for Medical Assistance after depleting their insurance benefits, without losing the asset protection the Partnership Policy provides. Long-term care is a personal responsibility — its risk and cost should not be ignored. Medical Assistance is a safety net, but only for those truly in need. Everyone who is financially and medically qualified should begin now to save, invest and insure for long-term care.

What is a Long Term Care Insurance Pennsylvania Partnership Policy?

A Long Term Care Insurance Pennsylvania Partnership Policy is a long-term care insurance product. Policies pay for some, or all, of the expenses associated with a spectrum of personal-care services, ranging from home care to skilled nursing facility care. These new polices are part of a nationwide effort that consists of private/public partnerships that encourage people to purchase long-term care insurance by allowing them to keep their assets if they ever exhaust their insurance and have to turn to Medical Assistance. Protected assets are not considered in determining eligibility for Medical Assistance or estate recovery.

How does a Partnership Policy differ from other long term care insurance Pennsylvania policies?

A Long-Term Care Partnership Policy provides the added benefits of offering those who own them a way to protect their assets, dollar-fordollar, in the amount of policy benefits paid out on their behalf in the event they ever need to apply for long-term care benefits under Pennsylvania’s Medical Assistance program. Additionally, a Long-Term Care Partnership Policy has beneficial tax treatment and requires inflation protection features that protect younger purchasers from increases in expenses caused by inflation. For most people, the benefits of a Partnership Policy are likely to cover all the care they will ever need. However, because of the unique asset protection feature, you won’t have to impoverish yourself if you run out of benefit coverage and still need care.

What will it cover and how does it work?

A Long Term Care Insurance Pennsylvania Partnership Policy will cover some or all of the expenses for nursing home stays, community services such as adult day care, in-home care, assisted living facility care or a combination of these services. The type of care provided includes skilled nursing (daily nursing and rehabilitative care), intermediate (occasional nursing and rehabilitative care), custodial (personal needs such as walking, bathing, dressing) and home health care (part-time skilled nursing care, speech therapy, physical or occupational therapy).

SOURCE: Pennsylvania Insurance Department

This consumer guide contains information about long-term care options and long-term care insurance buying tips.

Personal Long-Term Care Insurance Assessment: a Supplement to the Pennsylvania Insurance Department’s Long-Term Care Insurance Guide

The State of Pennsylvania recommends:

Searching for Rate Increase information in Pennsylvania? We have the answers you need.