Long Term Care Insurance Policy Brochures for North Carolina

Introduction

Long-term care issues can be complex and confusing. With so many options, services and settings in which care is given, many people delay learning about the issues until they are personally affected. Unfortunately, that is likely to be the time when you are under the most pressure to make a decision, and when time is too short to carefully weigh your options.

Because these long-term care issues deserve your careful attention, don’t wait until it’s too late to find out all you can about this important health care alternative. This brochure can give you direction and information on services and resources available in

North Carolina to help you with your long-term care decisions. Don’t wait any longer to find out important information!

What is Long-Term Care?

Long-term care is the day-in, day-out assistance you might need if an illness or disability lasts a long time and leaves you unable to care for yourself. This may or may not include a nursing home stay. In other words it is a continuum of services that can be provided in a variety of settings ranging from one’s own home, assisted living facility, adult day care facility or a nursing home. Long-term care covers a broad spectrum of care and services ranging from basic personal care to medical care.

What is the Long Term Care Insurance North Carolina Partnership (LTCP)?

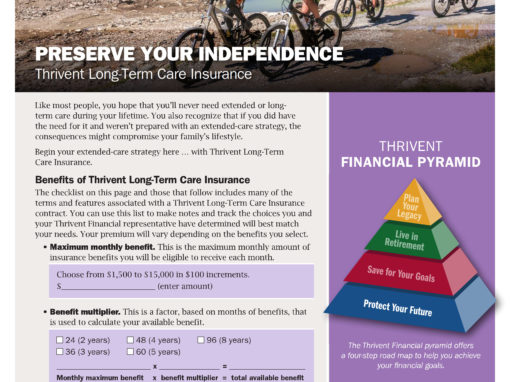

During 2010, North Carolina legislators passed Session Law 2010-68, i.e., Senate Bill 1193, authorizing the establishment of the Long Term Care Insurance North Carolina Partnership (LTCP) program. The LTCP is an innovative partnership between North Carolina Medicaid and private insurers of long-term care insurance policies. It is designed to assist North Carolinians in planning for their cost of long-term care needs while providing the consumer with protection of some or all of their assets. If a LTCP policyholder’s long-term care needs extend beyond the period covered by their private policy, they can access Medicaid LTC benefits without meeting the usual asset “spend down” rules. Only partnership policies provide Medicaid asset protection.

A long-term care product must meet specific requirements to be considered a “partnership policy.” It must be a tax-qualified policy; contain specified inflation protection if sold to an individual under age 76; meet certain consumer protection requirements; and the insured must be a resident of the state when the coverage becomes effective. Partnership policies are available from participating insurance companies who are authorized by the North Carolina Department of Insurance to market and sell these policies.

SOURCES:

North Carolina Department of Insurance

This consumer guide contains information about long-term care options and long-term care insurance buying tips.

The State of North Carolina recommends:

Searching for Rate Increase information in North Carolina? We have the answers you need.