Long Term Care Insurance Policy Brochures for South Carolina

The LTCP involves private long term care insurance insurers, long term care insurance producers (agents and brokers), the South Carolina Department of Health and Human Services (SCDHHS) and the Department of Insurance (DOI). Although the Partnership is overseen by the federal Centers for Medicare and Medicaid Services (CMS), each state has a great deal of autonomy in its administration. In South Carolina, qualified LTCP policies must provide a specific amount of inflation protection based on the person’s age when the policy is purchased and must meet other requirements determined by the Department of Insurance.

A person who requests Medicaid assistance of LTC services after exhausting some or all benefits of a qualified LTCP policy may have certain assets “disregarded” equal to the benefits paid by the qualified LTCP policy at the time the person is determined eligible for Medicaid. These assets are not counted when the person’s Medicaid eligibility is determined and will not be recovered during estate recovery when the person dies.

Interaction between the Long Term Care Insurance South Carolina Partnership Program and Medicaid Eligibility

1. A LTCP participant in South Carolina is someone who either:

- Requests Medicaid payment of Long Term Care services after exhausting all benefits of a qualified LTCP policy, or

- Exhausts all benefits of a LTCP policy while receiving Medicaid payment of LTC services, or

- Receives Medicaid payment of LTC services and dies before the LTCP policy benefits are exhausted.

2. In determining Medicaid eligibility, SCDHHS will disregard an individual’s assets in an amount equal to the number of payments made by the individual’s qualifying LTCP policy for services covered under the policy. Documentation of

the amount of benefits paid will have to be provided.

3. A LTCP participant receives the following benefits during his or her lifetime:

- Assets may be designated for protection in an amount equal to the total amount of LTC services paid by the qualified LTCP policy

- Designated assets are not counted toward the Medicaid asset limit

- The designated assets may be transferred to any other person without penalty.

4. After the LTCP participant is deceased:

- Assets which were designated as protected during the person’s lifetime are also protected from estate recovery

- When the amount of assets protected during the person’s lifetime was less than total benefits paid by the LTCP policy, additional assets may be protected in the estate recovery process – up to the total amount paid by the LTCP policy

- If no assets were protected during the person’s lifetime, the personal representative may designate assets to protect from estate recovery equal to the total amount paid by the LTCP policy – even if LTCP policy benefits were not completely exhausted.

5. Owning a LTCP policy does not guarantee eligibility for Medicaid, even if the policyholder exhausts all benefits. Individuals must still meet all other Medicaid eligibility requirements. The LTCP allows policyholders to have a portion of their assets disregarded (not counted) during the eligibility process and subsequently protected from estate recovery. REMINDER: Only SCDHHS can determine whether a person will qualify for Medicaid. Agents should be careful not to advise

regarding eligibility requirements or whether a person will be eligible for Medicaid.

10 Things You Should Know About Buying Long Term Care Insurance South Carolina

-

Long Term Care is Different From Traditional Medical Care

Someone with a prolonged physical illness, a disability or a cognitive impairment, such as Alzheimer’s disease, often needs long term care. Long term care services may include help with daily activities, home health care, respite care, hospice care, adult day care, care in a nursing home or care in an assisted living facility. -

Long Term Care Can be Expensive

The cost depends on the amount and type of care you need and where you get it. In 2001, the national average cost of nursing home care was $56,000 per year, assisted living facilities reported $22,476 per year and home care costs ranged from $12,000 to $16,000 per year. -

You Have Options When Paying for Long Term Care

People pay for long term care in a variety of ways. These include using personal resources, long term care insurance, and Medicaid for those who qualify. Medicare, Medicare supplement insurance and health insurance you may have at work usually will not pay for long term care. Long term care insurance will pay for some or all of your long-term care. -

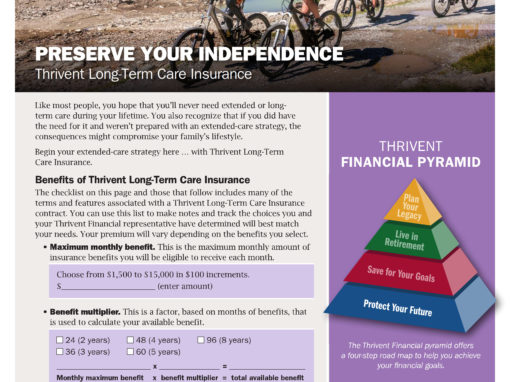

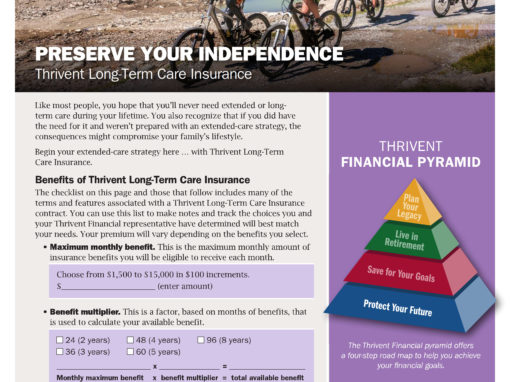

Decide Whether Long Term Care Insurance is for You

Whether you should buy a long term care insurance policy will depend on your age, health status overall retirement goals, income and assets. For instance, if your only source of income is a Social Security benefit or Supplemental Security Income (SSI), you probably should not buy long term care insurance since you may not be able to afford the premium. On the other hand, if you have a large amount of assets but do not want to use them to pay for long-term care, you may want to buy a long term care insurance policy. Many people buy a policy because they want to stay independent of government aid or the help of family. They don’t want to burden anyone with having to care for them. However, you should not buy a policy if you can’t afford the premium or are not sure you can pay the premium for the rest of your life. -

Pre-Existing Condition Limitations

A long term care insurance policy usually defines a pre-existing condition as one for which you received medical advice or treatment or had symptoms within a certain period before you applied for the policy. Some companies look further back in time than others. Many companies will sell a policy to someone with a pre-existing condition. However, the company may not pay benefits for long term care related to that condition for a period after the policy goes into effect, usually six months. Some companies have longer pre-existing condition periods or none at all. -

Know Where to Look for Long Term Care Insurance

Long term care insurance is available to you in several different forms. You can buy an individual policy from a private insurance company or agent or you can buy coverage under a group policy through an employer or association membership. The federal government and several state governments offer long-term care insurance coverage to their employees, retirees, and their families. You can also get long-term care benefits through a life insurance policy. Some states have long-term care insurance programs designed to help people with the financial impact of spending down to meet Medicaid eligibility standards. Check with the Department of Insurance to see if these policies are available in our state. -

Check With Several Companies and Agents

Contact several companies and agents before you buy a long-term care policy. Be sure to compare benefits, the types of facilities covered, limits on your coverage, what is not covered and the premium. Policies from different insurance companies often have the same coverage and benefits but may not cost the same. Be sure to ask companies about their rate increase history and whether they have increased the rates on the long-term care insurance policies. -

Don’t be Misled by Advertising

Most celebrity endorsers are professional actors who are paid to advertise, not insurance experts. It is also important to note that Medicare does not endorse or sell long-term care insurance policies, so be wary of advertising that suggests Medicare is involved. Do not trust cards you get in the mail that look like official government documents until you check with the government agency identified on the card. -

Make Sure the Insurance Company is Reputable

To help you find out if an insurance company is reliable, you can take the following actions: Stop before you sign anything, contact the Department of Insurance and confirm that the insurance company is licensed to do business in our state. After you make sure they are licensed, check the financial stability of the company by checking their ratings. You can get ratings from some insurer rating services for free at most public libraries. -

Review Your Contract Carefully

When you purchase long term care insurance, your company should send you a policy. You should read the policy and make certain you understand its contents. If you have questions about your insurance policy, contact your insurance agent for clarification. If you still have questions, contact the Department of Insurance.

The State of South Carolina recommends:

Searching for Rate Increase information in South Carolina? We have the answers you need.

For further assistance, please contact us.