Long Term Care Insurance Policy Brochures for California

Long Term Care Insurance California

Long-term care issues can be complex and confusing. With so many options, services and settings in which care is given, many people delay learning about the issues until they are personally affected. Unfortunately, that is likely to be the time when you are under the most pressure to make a decision, and when time is too short to carefully weigh your options.

Because these long-term care issues deserve your careful attention, don’t wait until it’s too late to find out all you can about this important health care alternative. Don’t wait any longer to find out important information!

What is Long-Term Care?

Long-term care is the day-in, day-out assistance you might need if an illness or disability lasts a long time and leaves you unable to care for yourself. This may or may not include a nursing home stay. In other words it is a continuum of services that can be provided in a variety of settings ranging from one’s own home, assisted living facility, adult day care facility or a nursing home. Long-term care covers a broad spectrum of care and services ranging from basic personal care to medical care.

Long Term Care Insurance California Shopping Tips

- Shop around for an insurance agent and an insurance company–ask friends, family or neighbors if they recommend their insurance agent or company.

- Ask insurance agents which insurance company’s products they sell; most agents only sell products from a few companies. Compare several different products from several different insurance companies. You might need to talk with several different agents.

- Carefully compare the benefits and restrictions between policies.

- Most LTC insurance premiums increase over time. Carefully evaluate whether premium payments over a long period could be a financial hardship.

- Never pay insurance premiums in cash; do not make checks payable to the insurance agent.

- Read your policy carefully and ask follow up questions.

- Use your 30-day “Free Look” period to return a policy for a full refund if you are not satisfied!

- Understand what a Long Term Care Partnership (LTCPP) policy is, how it differs from non-LTCPP policies, and whether it is affordable for you.

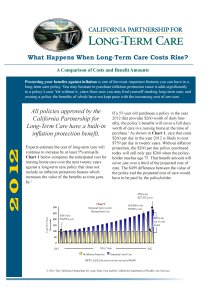

California Partnership for Long-Term Care provides consumers with excellent educational guides to learn more about long-term care insurance. Four of their brochures are available for immediate download by clicking the photo.

Established in 1994, the Partnership is a revolutionary program designed to help Californians successfully navigate long-term care issues.

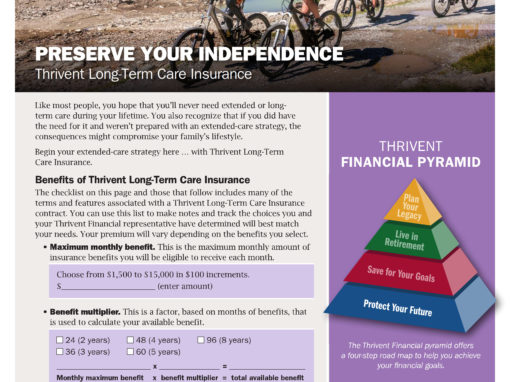

The Partnership works with select private insurance carriers, who meet stringent standards set by the state, to develop unique insurance policies that protect you and your family from the devastating costs and hardships that are often associated with long-term care. All Partnership-approved policies contain vital features necessary for high quality long-term care insurance coverage, including:

- Built-in automatic inflation protection of 5 percent annually.

- Care coordination and monitoring by licensed health professionals independent of the insurance company to develop a Plan of Care based upon your individual needs and resources.

- Once in a lifetime deductible so that if you stop using policy benefits and then must use them again, you will not have to pay a second deductible.

- Waiver of premium for all days your policy pays for care in a nursing or residential care facility.

- Flexibility on the use of home- and community-based benefits.

- Medi-Cal asset protection to ensure a portion of your assets are protected should you need to rely on Medi-Cal.

The State of California recommends:

Searching for Rate Increase information in California? We have the answers you need.

For further assistance, please contact us.